Read

Read

International accounting observations, tracking overseas regulatory agencies, standards bodies, industry associations, industry media, international accounting networks, etc., extract the essence of this article.

Workplace and education

Become an agile CFO.

KPMG's survey of approximately 1,300 CEOs in 2019 revealed that 67% of CEOs said: "Agile is the new currency for businesses; if we are too slow, we will go bankrupt." This is a little bit more than 59% in 2018 increase. According to Jacek Kaczmarek, head of the finance function of the Polish Development Fund, agile CFOs are committed to turning potential risks into more profits and protecting companies from lost revenue due to changes in customer behavior. An agile CFO oversees agile financial functions and changes as technology advances--such as automating financial planning and analysis--thus moving the finance team from focusing on data preparation to more forward-looking and high-value creation activities .

Agile CFOs can consider three strategies:

1. Respond to change. Better adapt to changing market dynamics, enable new business models, and proactively manage risk and compliance. Become more insightful and provide stakeholders with accurate, timely and actionable information. Improve efficiency by providing financial services at a competitive cost while flexibly meeting demand.

2. Embrace key technologies. "Choosing technologies that will help me get to my destination faster." Jaipati of EY pointed out seven technologies that CFOs should adopt: (1) cloud computing and (2) intelligent automation, such as machine learning and RPA. (3) Internet of Things (4) Blockchain (5) Big Data and Analysis (6) Digital Processes and Network Security.

3. Be proactive

To develop a mindset of continuing learning, CFOs need to meet with business managers on a regular basis to discuss new technologies, trends, or anything new and interesting, even if these new things are not directly related to finance, but may affect the company's competitive advantage and financial performance . "You don't know what you don't know, that's the biggest risk."

Audit institutions should be cautious about the development of blockchain.

Amy Steele, a Deloitte audit and assurance partner and co-chair of the AICPA Digital Asset Working Group, believes that the development of the blockchain will affect the audit industry and change the status quo. Many companies are studying how to use blockchain within the company, but this is more in the idea phase than the implementation phase. He believes: "When we look at the digital assets on the company's books, one of the biggest risks is that they own the rights to those assets. In the digital asset environment, the rights to the word assets are driven by the control of the private key, if the key is lost Or stolen, the asset may not belong to the entity. "" We have all seen articles saying that blockchain will replace the need for auditors, but I don't think this is the case. "The valuation of blockchain assets is also possible Difficultly, auditors will need to be vigilant against violations of the law, as Bitcoin has a reputation for its use in activities such as money laundering, illegal drugs and human trafficking.

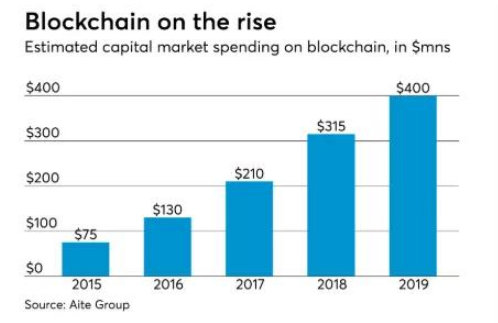

US investment in blockchain (in millions of US dollars)

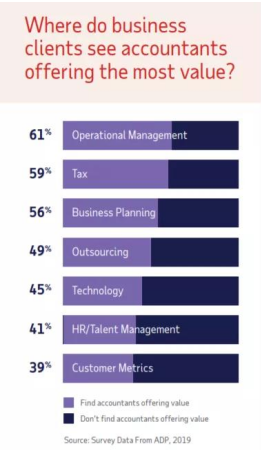

Where do business clients see accountants offering the most value

Accounting firm value in the eyes of US commercial clients. Operation management, taxation, business plan, outsourcing, technology, human resources / talent management, and customer indicators.

"Accounting is about records, classifications and reports. Auditors tend to take a top-down approach, worrying about classifications and reports rather than records. Rather than extending auditing to report every politician, as the Lord Brighton report says Every 'new thing' thinking around the vague term of the public interest, it is better to let the audit return to the basics and only report the balance sheet, profit and loss and cash flow. The lesson of failed audits is that audits only focus on what exists, and Not missing content.

market

The global accounting software market is expected to grow.

Sage's cloud software subscription penetration has increased from 28% to 67%. A report published by Fortune magazine said: "The global accounting software market size was valued at USD 10.716 billion in 2018 and is expected to reach USD 20.408 billion by the end of 2026, with a compound annual growth rate (CAGR) of 8.02%." In January, the magazine predicted the rapid growth of cloud-based software. However, Nester's report is more cautious. The structure in October last year predicted a CAGR of 6.3% from 2017 to 2024. According to the agency's data, the global business accounting software market's revenue was worth $ 3.2 billion in 2016. The software companies mentioned in the research reports of both companies do not have Chinese companies.

Standards and supervision

At the end of 2019, the British government launched the fifth EU money laundering directive (5MLD), which will take effect on January 10, 2020. The new directive will require companies in the financial services industry to take immediate action if they have not implemented the required changes. This also requires accounting firms and other professional services companies to strengthen due diligence checks, provide their employees with anti-money laundering training, and use electronic verification "where possible", which means that paper can still be used in some cases Inspection. Failure to do so will result in prosecution and fines.

The United States Securities and Exchange Commission (SEC) has proposed amendments to audit independence requirements. The proposal would allow auditors to build partnerships with clients without substantially threatening auditor independence.